Veritex Bank Government Lending

Small Business Administration

SBA Loan Program

Whether your business is growing or already well-established, Veritex Bank is here to support your next move. Take advantage of competitive funding through one of the four SBA loan programs offered—each designed to meet the unique needs of small businesses. Apply today and discover how Veritex Bank means business.

SBA Loan Programs

Veritex Bank Government Lending is a trusted SBA Preferred Lender, approved to offer a full suite of SBA loan products. We proudly deliver four distinct programs designed to support the backbone of the U.S. economy — small businesses. Our team is here to help you find the right solution to fuel your growth.

SBA 7(a) Loan

BEST USES

Business Acquisitions, Buy-Outs, Expansions, Real Estate Purchase or Renovation, Equipment & Inventory, Refinancing Existing Debt

_____________________________

QUALIFYING BUSINESSES

For-Profit. Nationwide. Operating in the U.S.

Net Worth < $20 million and 2-Yr. Avg. Net Income < $6.5 million

_____________________________

LOAN PARAMETERS

Up to $5 Million

_____________________________

TERMS

25 Years (Commercial Real Estate)

10 Years (Other Purposes)

SBA 504 Loan

BEST USES

Owner-Occupied CRE Purchase, Land or Building Acquisition, Ground-Up Construction or Major Renovations, or Equipment Purchase with Useful Life of 10+ Years

_____________________________

QUALIFYING BUSINESSES

For-Profit. Nationwide

Net worth below $20 million and net income below $6.5 million.

_____________________________

LOAN PARAMETERS

~$5.5 Million from the SBA Portion

Upwards to $15 Million Total Project Cost

_____________________________

TERMS

25 Years (Commercial Real Estate)

10 Years (Machinery & Equipment)

SBA Express

BEST USES

Quick access to working capital, equipment purchase, inventory, debt refinancing, & more.

_____________________________

QUALIFYING BUSINESSES

Most For-Profit Small Businesses that meet SBA size standards

_____________________________

LOAN PARAMETERS

Up to $500,000

Up to 50% SBA Guarantee

_____________________________

TERMS

Up to 7 Years for Lines of Credit

Up to 10 Years for Equipment & Working Capital

SBA International Trade

BEST USES

Export Expansion, Export-Related Working Capital, Debt Refinancing for International Trade Operations

_____________________________

QUALIFYING BUSINESSES

Small Businesses engaged in International Trade or negatively impacted foreign competition

_____________________________

LOAN PARAMETERS

Up to $5 Million

Up to 90% SBA Guarantee

_____________________________

TERMS

Up to 10 Years for Equipment & Working Capital

Up to 25 Years for Real Estate

Is your project located in a rural area?

You may qualify for additional funding options from the USDA OneRD Loan Program.

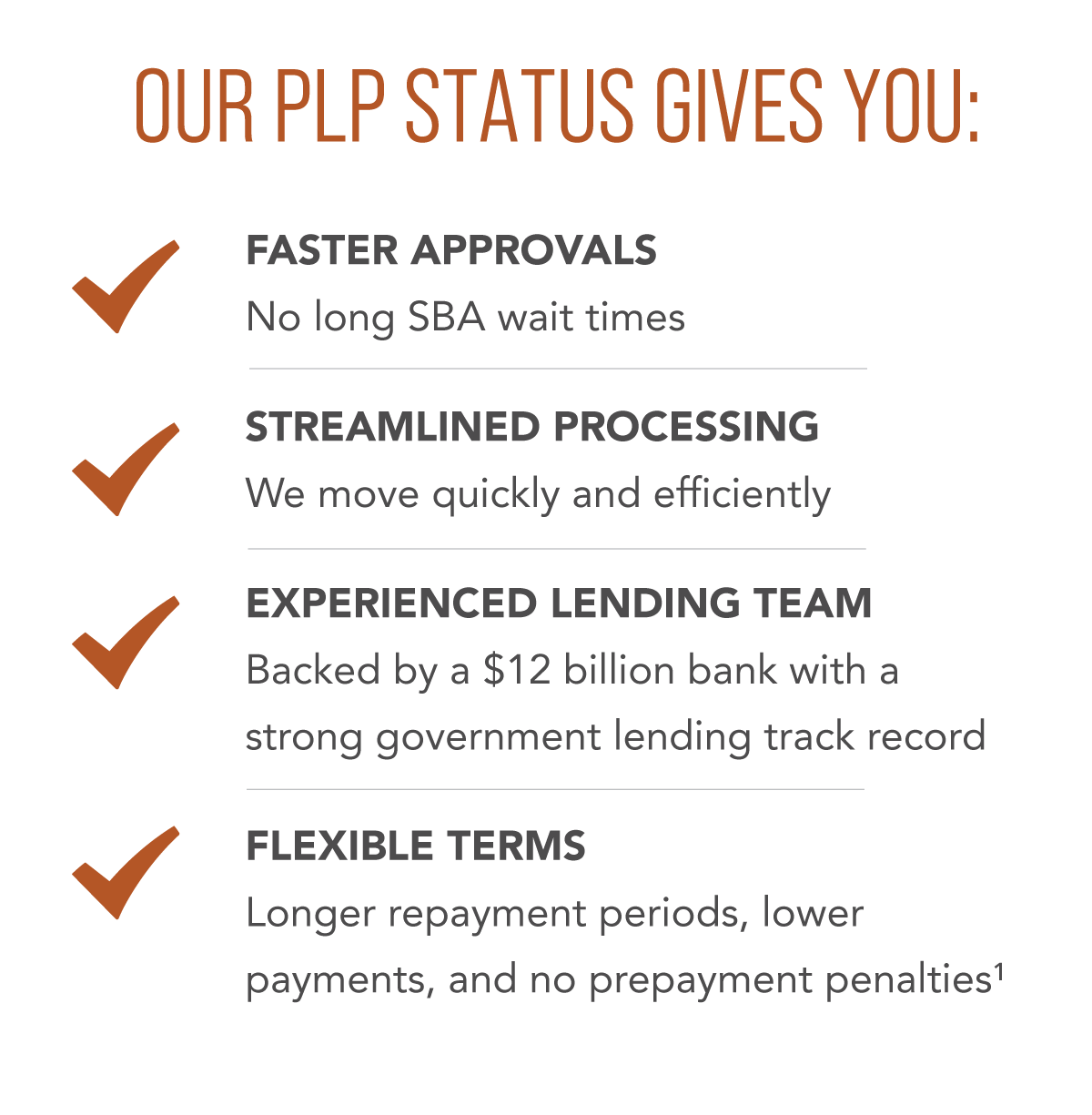

Why Choose a

Preferred Sba Lender?

Fast, In-House Approvals with a Preferred SBA Lender

At Veritex Bank Government Lending, we're proud to be designated as an SBA Preferred Lender (PLP)—a status granted only to top-tier lenders with a proven track record and deep understanding of the SBA loan process.

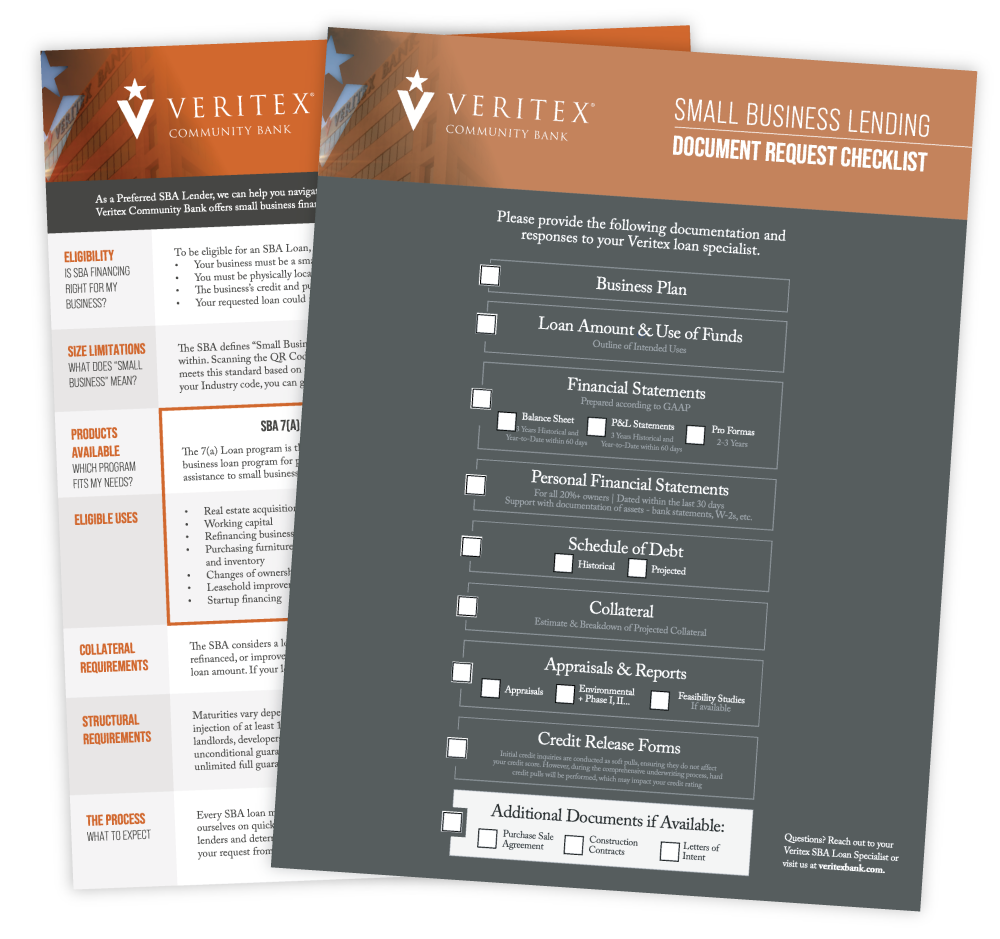

Helpful SBA Downloads

Get deeper insights into SBA loan programs, eligibility, and structuring. These free resources are designed to help business owners and brokers make smarter, faster financing decisions.