Current State of the Market

As we prepare to publish this, the U.S.’ newly imposed tariffs have shaken global financial markets, causing major stock indices like the Dow, S&P 500, and Nasdaq to drop sharply. Investors fear higher inflation and slower economic growth as a result. The tariffs, starting at 10% and going even higher for certain countries, have sparked international backlash and threats of retaliation, raising concerns about a possible global trade war and recession. Meanwhile, political opposition is growing within the U.S., with the Senate taking steps to challenge some of the tariff measures.

Needless to say, 2025 is off to a fast start! Let’s take a quick look at what’s happening in the insurance world as we wrap up Q1. Overall, things seem fairly stable, which is good news after a few bumpy years. For those of you in the property and casualty (P&C) insurance business, the forecast looks steady, with earnings expected to remain strong through next year. We saw some really good growth in premiums recently, but it looks like that pace might slow down a bit as companies focus on making sure their rates are in the right spot for the long haul. Interestingly, most insurance companies are planning to keep their staffing levels the same or even hire more people, which shows a lot of confidence in the market. Of course, there are always things to keep an eye on, like global events and how the economy is doing, as these can have an impact on everyone. Plus, technology is changing fast, with things like AI becoming a bigger part of the picture for insurers. There are also some new rules and regulations coming out around things like climate risk and cybersecurity, so that’s something the industry will be paying close attention to.

Now, let’s dive into some specific areas. If you’re in the P&C sector, you’re probably seeing continued growth in how much you collect in premiums. This is partly because the costs of claims have been high due to natural disasters and what’s called “social inflation”. While the big rate increases might be leveling off as companies try to attract more customers, the impact of things like wildfires is still a major concern. On the commercial property side, it seems like the market is finding its footing, and rate changes will likely depend more on a company’s individual track record. If a business has had few claims, it might see lower rates or small increases, but those with more claims could face bigger jumps. One ongoing challenge in P&C is the rising cost of claims, especially in commercial auto insurance, which continues to be a tough area for profitability. Meanwhile, the life and health insurance market is looking at more consistent, though perhaps slower, growth this year. With more people needing to save for retirement, there’s a big opportunity here for financial planning and related insurance products. For insurance agencies and brokerages, we’re seeing continued consolidation happening, even though most expect their revenues to grow. The market for auto extended warranties is also set to expand quite a bit, driven by higher repair costs and the increasing complexity of cars. And for third-party administrators, the focus is on upgrading their technology, especially with AI, to improve their services.

So, what does all this mean for us in the banking world, especially here at Veritex Community Bank? Well, the overall stability and expected growth in many parts of the insurance market, like P&C, life and health, and auto warranties, mean there will be continued demand for the kinds of financial services we offer. This includes things like loans for growth, investments in new tech like AI, and help with managing cash flow. The ongoing challenges in the P&C sector, such as dealing with natural disasters and rising claim costs, highlight the need for strong financial risk management, which is where we can help with our expertise and financial tools. Even the economic uncertainties and global tensions could lead insurance companies to seek our advice. Since Veritex Bank already works with a wide range of insurance companies – from property and casualty to life and health, agencies, warranty providers, and more – we’re in a great position to support your needs in 2025. By staying connected with our insurance clients and offering solutions tailored to their specific challenges and opportunities, Veritex Bank can continue to be a valuable partner in the insurance industry.

Premium Finance Launch

Veritex Bank is excited to announce that our Insurance Banking Group has formed Veritex Premium Finance and will soon be offering commercial premium finance solutions to agencies and brokers for their clients throughout the Southwest. This new offering will provide a valuable tool for YOUR customers to manage THEIR working capital and insurance costs effectively. We anticipate launching this service within the next six months and look forward to partnering with you to meet your clients’ financing needs. Interested in learning more, visit us HERE or send us a message at Veritex Premium Finance.

The first quarter of 2025 is over, and I hope you took my advice to buckle your seat belt and hold on, 2025 is shaping up to be a wild ride for the economy. President Trump took office in January and with Elon Musk and others at his side wasted no time taking aim at “wasteful government spending.” Whether you agree or disagree, and there are plenty of people on both sides, I hope that in the long-run cooler heads (on all sides) will prevail. Confusion, chaos, rumors, and claims abound as President Trump almost immediately took aim at the Consumer Finance Protection Bureau (CFPB), a relatively young government agency that was created in the aftermath of the 2008 financial crisis and charged with protecting consumers in financial transactions with banks and other financial companies. Other agencies and departments followed. He also engaged head-on with pretty much all our trading partners at once, matching tariffs imposed on the U.S. in some cases, and implementing new tariffs in others, targeting large swaths of US imports including wine, automobiles, and hundreds of others.

I don’t know how all of this is going to end up, honestly, I don’t think anyone does. But I would like to take a closer look at a few things that I can see with my own eyes and hopefully leave politics on the side.

1. Department of Government Efficiency (doge.gov)

If you haven’t been to the website, please go. Snoop around for a few minutes and see what you can find. The Trump administration seems to be offering an unprecedented amount of information (read: transparency), the likes of which I have never seen in my lifetime; even offering pages and pages of government payments, showing you where your tax dollars are going. Is it all true? I have no idea. But the amount of information is daunting and making it available for public dissemination is breaking some glass.

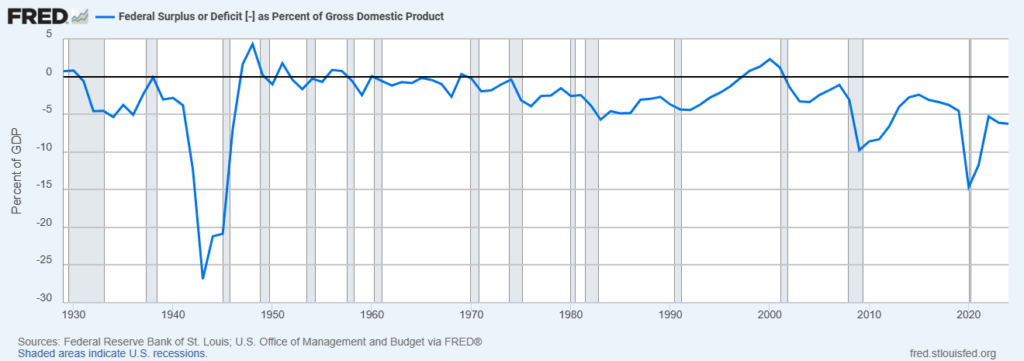

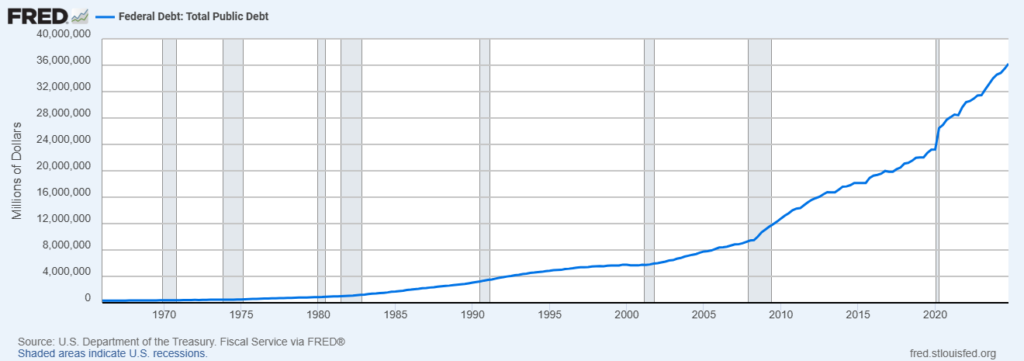

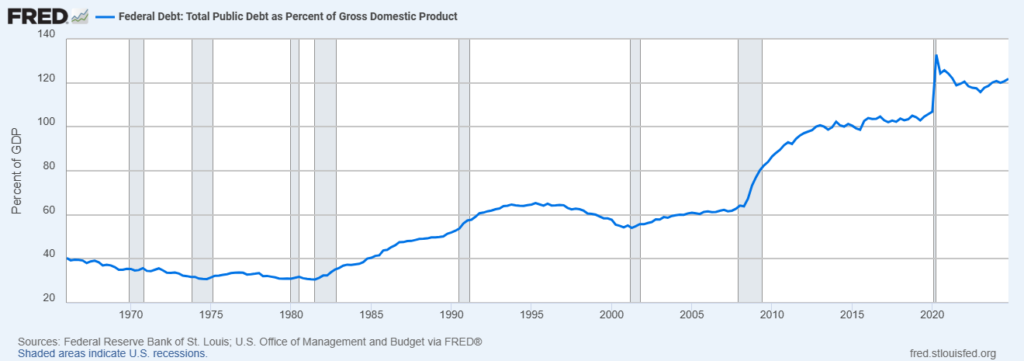

2. Government Spending (charts courtesy of Federal Reserve Bank of St. Lous website – fred.stlouisfed.org)

Sorry about all the charts, but the visual really helps me put everything into context.

The U.S. hasn’t had a balanced budget since Bill Clinton was president in 2000, that’s 25 years ago. Recent deficits seem to be trending larger, including during President Trump’s first term in office.

Total government debt has blossomed to over $36 trillion and currently exceeds 120% of GDP even as GDP is annually setting new, all-time highs. Total government debt peaked (for now) at 126.3% of GDP during the COVID-19 crisis in 2020 and hit a low of 31.8% of GDP back in 1981 (not that long ago for some of us who are still young at heart).

With interest rates increasing over the past two years, interest on the debt has more than doubled from around $500B in 2020 to more than $1.1T in 2024.

3. Monetary policy strength vs. Fiscal policy strength

Changing the course of the U.S. economy is a lot more akin to turning a cruise ship than to turning a sports car. Historically, the Fed takes an action (raises or lowers rates, increases or decreases the money supply, etc.), and then it waits, sometimes for months or quarters to try to gauge the economic impact through changes in economic statistics. It can be a slow, sometimes painful process, and there are often unexpected bumps or bruises along the way. And what if there is a more difficult to see undercurrent, in the form of fiscal policy, that is also impacting the economy? Interpreting or anticipating the relative influence can be incredibly difficult.

What if the comparative strength of monetary policy vs. fiscal policy is changing? Higher debt burdens on the budget might make it more difficult for the Fed (monetary policy) to raise interest rates as high as they would like – see the doubling of interest expense over the past four years above. It stands to reason that this might limit the power of monetary policy. Taking greater control of government spending, introducing or raising tariffs, and other fiscal policy actions may also increase the strength or impact of fiscal policy vis-à-vis monetary policy.

The Federal Reserve Chair is appointed by the president, roughly halfway through their administration for a four-year term, so the incoming president must live with the previous Fed Chair for a couple of years before they get to appoint their own. Chair Jay Powell was originally appointed in 2018 by then-President Trump and was then reaffirmed by President Biden in May of 2022. While I don’t believe that President Trump will attempt to “fire” Chair Powell early, his term does expire in May of 2026 and President Trump will get to appoint a new Fed Chair. Based upon recent disagreements as to the path of monetary policy pursued by the Fed, I feel quite certain that President Trump will appoint a new Fed Chair, and likely one who more closely shares his economic worldview. This, at least temporarily, would also seem to have some impact on the direction, if not the actual influence of monetary policy vs. fiscal policy.

4. Future Fed Action (Wait and See)

While points 1-3 above are a little off my normal “economic update” path, this one gets us squarely back on the path. Recently, Fed Chair Powell invoked the term “transitory” about the impact of President Trump’s tariffs. Why would he use that word specifically? The last time he used “transitory”, it was regarding inflation back in 2022, which turned out to be anything BUT transitory! Is there a hidden message that Powell is really worried about the impact of tariffs? I don’t know, sometimes Fed Speak can be difficult to interpret, but I find this noteworthy!

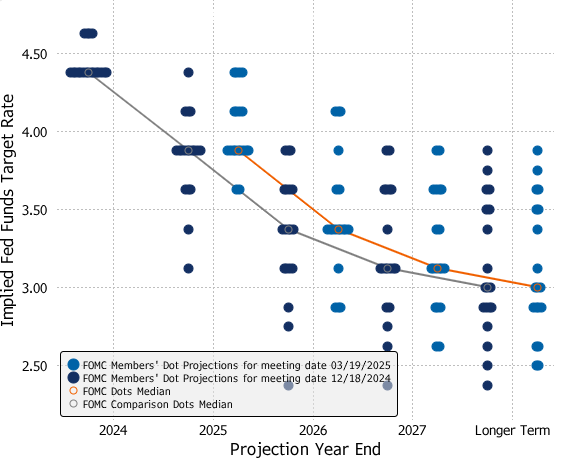

Between the January 29 Fed meeting and the March 19 Fed meeting, the Fed changed the language in the second paragraph of its statement from “The Committee judges that the risks to achieving its employment and inflation goals are roughly in balance,” to “Uncertainty around the economic outlook has increased.” So, while it acknowledged the additional volatility or uncertainty, the “Dot Plot” (courtesy of Bloomberg) showed no meaningful change, still indicating a base case scenario of two rate cuts in 2025, although just barely. If you look closely at the dark blue dots (December) vs. the light blue dots (March), you can see that a few of the lower dots in each of 2025, 2026, 2027 and Longer Term shifted higher, although not enough to shift the median line upward (all that means is that the middle dot didn’t change).

So, while the Dot Plot remained basically the same from December to March, there were some subtle shifts behind the scenes indicating that more of the voting FOMC members are expecting a slightly reduced likelihood of rate cuts through the term of the chart. Several speaking Fed Governors, as well as Mohamed A. El-Erian, former CEO of Pimco have recently embraced the view that there will be only one Fed rate cut enacted in 2025. Wait and see.

The market on the other hand is going somewhat aggressively in the other direction, currently pricing in as many as three rate cuts in 2025. The current indication is for a 25-bps rate cut in July, another in September, and a final 25 bps cut in December of 2025. As we saw last year prior to the election, I think this is “wishful thinking” by the market, and we are highly unlikely to see three rate cuts in 2025.

5. A Final Word – Volatility

The S&P 500 index last year went up about 24%. There were some ups and downs but, overall, a pretty steady upward trend. The largest retracement occurred between July and August, when the index dropped about 8.6% over approximately three weeks. So far in 2025, we started January and half of February up about 5%, then 10% down from the peak in mid-March and more volatility after that. Similarly, the 10-year Treasury initially went up about 25 bps in January but has since fallen over 65 bps from the peak and now hovers around 4.15%. I guess my message here is that I expect us to live with volatility going forward for a while as the market tries to sort out tariffs, government spending, government layoffs, and other policy changes that are likely to have an impact on our economic future. My suggestion is not to try to catch every single wind of change and ride it, rather try to look through the volatility to the underlying fundamentals and hold onto positions that are more likely to benefit you over the long run and fit within the basics of your organizational structure. Maybe easier said than done.

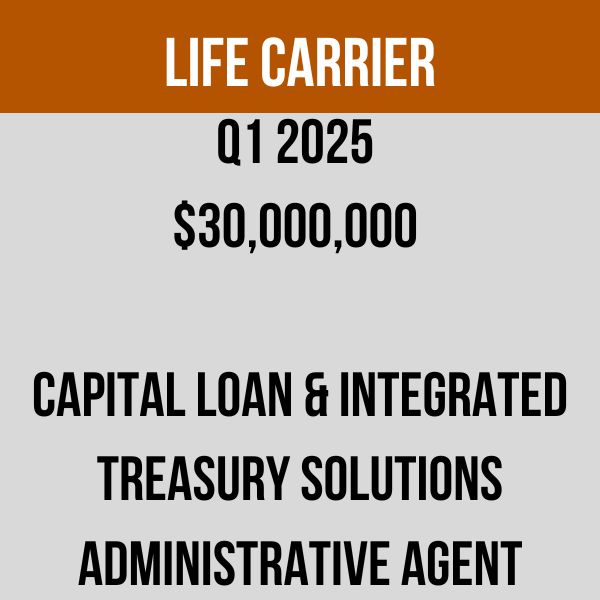

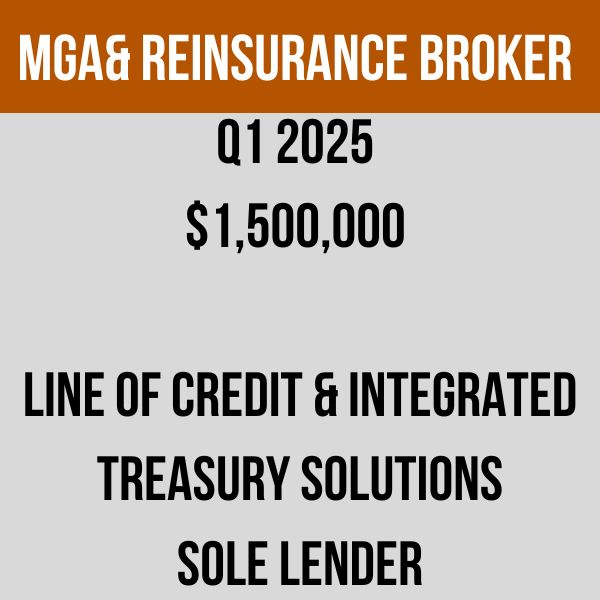

2025 Closings

Golf Bank of Texas

The start of the new PGA Tour season means many things for players; a new start, new sponsors/equipment, and in many cases, new contracts. For the entities that sponsor players, it also includes a renewal of insurance policies.

Golf sponsorship contracts aren’t that different than what you hear about for coaches and athletes in other sports. Typically, there is a base component and performance incentives. Behind the scenes, companies, sports teams, and athletic departments often seek insurance for lofty bonus clauses.

The insurance clauses offer two main advantages. One, the ability to offer a player more upside, and, in a sport like golf, essentially bet on themselves. More important, the emotional capability to constantly root for a player’s best performance instead of positive results wrecking a bottom line.

As Veritex Bank releases it’s 2025 list of players, a group we are excited to announce, we are fully invested in seeing their best result week in and week out. The list of Veritex’s Golf Ambassadors can be found here.

NIL and Augusta National Women’s Amateur (ANWA)

Name, Image, and Likeness (NIL) rights remain a hot topic related to college and amateur-based sports. It’s theorized that NIL and transfer portal rules have eradicated the Mid-Major Conferences from creating the Cinderella effect during the NCAA’s March Madness Tournament. Players who have success at smaller schools are instantly lured to the larger ones with pay for play promises by boosters and associated businesses.

It’s a murky business that both Congress and the NCAA have tried to create regulation around, and Federal Court rulings will soon dictate even more. An April 7 settlement hearing for a class action complaint, the ‘House Settlement’ will reshape the landscape. Key provisions include athletes receiving payment directly from schools, revenue sharing between schools and athletes, and compensation for former athletes. However, there are continued concerns about Title IX and antitrust violations via a cap on compensation.

Veritex Bank currently dabbles in the space but does so with up-and-coming golfers who fit into the larger mission of the #TeamVeritex philosophy (learn more about how we select our #TeamVeritex Golf Ambassadors here). We use it as a means to support amateur players on an individual basis and not necessarily because of school affiliation with the intent to ultimately develop a relationship with athletes ahead of their professional career.

The changing NIL landscape is visible at one of the last places that places a heightened value on amateurism, Augusta National Golf Club. The Augusta National Women’s Amateur (ANWA) was created in 2018 and, at its first playing featuring players invited based on their World Amateur Golf Rankings, included almost exclusively collegiate and National Team logos.

On the Road with Insurance Banking

Reflections from the Joe Vincent Seminar – Jan 26-28, 2025:

We had a fantastic time connecting with our agency partners at the Annual Joe Vincent Seminar in Austin. This year’s hot topic? The transformative impact of AI on the industry. While AI enhances efficiency for day-to-day tasks, we were reminded that strategic implementation requires experts who can interpret and optimize the data. After all, data is the Achilles’ heel for maximizing AI investments.

TALHI Legislative Forum and Lobby Day/Feb 18, 2025:

Veritex Bank as a proud sponsor partnered with TALHI staff, other sponsors, and members in Austin last month in visiting more than 40 Texas legislative offices, including those of the House Speaker, House Insurance Committee Chair, Senate Business & Commerce Committee Chair, Senate Health and Human Services Committee Director, and several new House Insurance committee members. Discussions with key staffers of the most pressing issues for the state and continuing to advocate for effective economic, legislative, and regulatory policies and oversight helps promote and ensure a sound and thriving life and health insurance market for all Texans.

IIAD Skeet Shoot – April 15, 2025:

Ready, aim, network! We’re joining IIAD’s annual scholarship shoot-out. While Veritex Bank might be known as the “golf bank of Texas” (and proud sponsor of Scottie Scheffler), we know how to hit a clay target too! Stop by our station for Veritex Swag and good company.

National Premium Finance Association Annual Meeting – April 24 – 25, 2025:

Our team is thrilled to attend this key industry meeting as we continue to move toward delivering comprehensive financing solutions to the insurance industry. We can’t wait to collaborate with professionals who share our passion for these financing solutions to ensure businesses can obtain the coverage they need.

Target Markets Mid-Year Meeting – May 6-8, 2025:

Come find us at the Hilton Anatole in Dallas, where 1,500 program business professionals will gather to explore opportunities with 90+ program carriers and distribution resources. Let’s discuss your insurance banking needs.

IIAT 128th Insurcon – June 23 – 25, 2025:

Insurcon has long been a key event for fostering strong relationships among agencies, carriers, vendors, and other industry peers. This year, our insurance banking team is thrilled to be part of this incredible gathering. Be sure to visit us at our tradeshow booth—we can’t wait to connect, collaborate, and explore opportunities to support your success!

Let’s make 2025 a year of connection and collaboration! We look forward to seeing you at these events.

As of our last writing, we have witnessed impactful and unprecedented events shaping the economy and, more specifically, the insurance industry.

First, we observed the inauguration of the 47th President, an event that has heightened trade and economic tensions, compounded by ongoing conflicts in Europe and the Middle East. The presence of technocrats at the inauguration signaled the growing financial influence of big tech in politics and a potential shift in global economic dynamics. Additionally, the rapid escalation of Elon Musk’s DOGE-related findings and their subsequent remediation further underscored real-time market volatility.

Secondly, we experienced multiple catastrophic events domestically, including headline-making wildfires in California and early-season convective storms in the Southeast. These events occurred even as discussions about reductions within FEMA continue, raising concerns about disaster response and funding.

Thirdly, the Federal Reserve continues to grapple with the delicate balance of inflation, economic growth, and employment. In its most recent mid-March meeting, the Fed opted to keep interest rates stable, a decision highlighted by our very own Jeff Smith in his commentary.

These developments will undoubtedly, if not already, have a direct impact on the broader insurance landscape.

- Political Implications: Tariffs on imported goods could sustain elevated repair costs, impacting claims expenses. However, property and casualty (P&C) insurers have been securing rate increases from regulators, compensating for losses incurred since 2020. Publicly traded insurers were up 7% as of early March, outperforming banks and the broader S&P 500, which experienced declines over the same period. Yet, as Warren Buffett pointed out in his annual investor letter, insurers’ cost of goods sold (COGS) remains largely uncertain until claims are made and settled months or even years later.

- Legislative Developments: In Texas, legislators are introducing several bills to combat the realities of the current insurance market. Notably, the Texans for Lawsuit Reform agenda is submitting a bill aiming to address excess nuclear verdicts. Additionally, there are talks of establishing a state-run auto insurance fund, offering mandatory liability and comprehensive coverage to enhance affordability. There is also a bill being introduced in its second iteration for AI which has been a widely contested piece of legislation.

- Healthcare Trends: While regulatory restrictions may be lifted, enforcement of the False Claims Act is likely to remain stringent to prevent fraud, waste, and abuse.

- Climate Risks: Insurance prices and weather-related events continue to dominate headlines, with climate change posing an increasing challenge for the industry.

- Interest Rates & Life Insurance Sector: The outlook for the Life & Annuity sector remains strong, characterized by high liquidity and robust capitalization. Annuity growth continues, fueled by competitive dynamics, including private equity entrants. Although interest rates are driving production, narrowing spreads may introduce pricing pressures and shifts in market share.

Beyond these key issues, emerging risks such as PFAS-related litigation, human trafficking, and other civil disturbances are gaining legal traction, necessitating increased vigilance from insurers.

In the legislative arena, several meaningful bills have been submitted, and the National Association of Insurance Commissioners (NAIC) has commenced a review of the Risk-Based Capital (RBC) model framework. This review aims to address the evolving balance sheets of insurers, including their growing exposure to private credit, private placements, and private equity, and to guide state regulators in assessing the liquidity of these assets.

As we navigate these evolving economic, regulatory, and environmental landscapes, insurers must remain adaptive and proactive in managing risks and opportunities.

We love connecting with new people in the insurance space and learning their stories. If you know anyone we should meet, please feel free to share this message or make an introduction to anyone on our team. We’re particularly interested in meeting business owners, lawyers, accountants, operators, and fellow bankers working in the insurance industry. The best way to reach us is through email – we’d greatly appreciate your referrals.

Thanks for keeping up with us and we’ll see you at the end of Q2!