whether your enterprise is large or small, veritex means business.

Secure competitive funding from the SBA today. Apply for one of our four loan programs designed specifically for small businesses through Veritex Community Bank now.

Contact Us

Veritex Community Bank is approved to offer SBA loan products under SBA's Preferred Lender programs.

We facilitate four distinct loan programs backed by the agency devoted to the needs of America’s economic bedrock: small businesses.

Small Business (SBA) Lending

Tricky. Complex. Overwhelming.

These are words often used to describe the SBA loan process. But small business owners who turn to Veritex are more likely to say something like, “Wow, that was simple.” You see, Veritex is an SBA top preferred lender. That means we have an in-depth understanding of the SBA landscape and are uniquely qualified to help you navigate the process.

Choose the bank rooted in truth, integrity, and transparency. Our SBA banking team has over ninety years of combined experience growing businesses like yours. We look forward to working with you and guiding you through the process.

Hurricane Beryl Business Relief

Low-interest federal disaster loans are available to Texas businesses and residents affected by Hurricane Beryl.

The disaster declaration makes SBA assistance available in:

PRIMARY COUNTIES: Brazoria, Chambers, Fort Bend, Galveston, Harris, Jackson, Jasper, Jefferson, Liberty, Matagorda, Montgomery, Nacogdoches, Orange, Polk, San Jacinto, Walker and Wharton counties.

CONTIGUOUS COUNTIES: Angelina, Austin, Calhoun, Cherokee, Colorado, Grimes, Hardin, Houston, Lavaca, Madison, Newton, Rusk, Sabine, San Augustine, Shelby, Trinity, Tyler, Victoria, and Waller.

Applicants may apply online and receive additional disaster assistance information at www.sba.gov/disaster.

Applicants may also call SBA’s Customer Service Center at

(800)659-2955 or Email disastercustomerservice@sba.gov

For people who are deaf, hard of hearing, or have a speech disability,

please dial 7-1-1 to access telecommunications relay services.

Deadline for Physical Damage:

Tuesday, September 10, 2024

Deadline to Apply for Economic Injury:

Monday, April 14, 2025

Veritex offers several SBA lending options, as well as USDA loans for rural businesses. Click on the links for more details or contact us with questions.

The great news about your business, is you have options, especially if traditional lending is not an option.

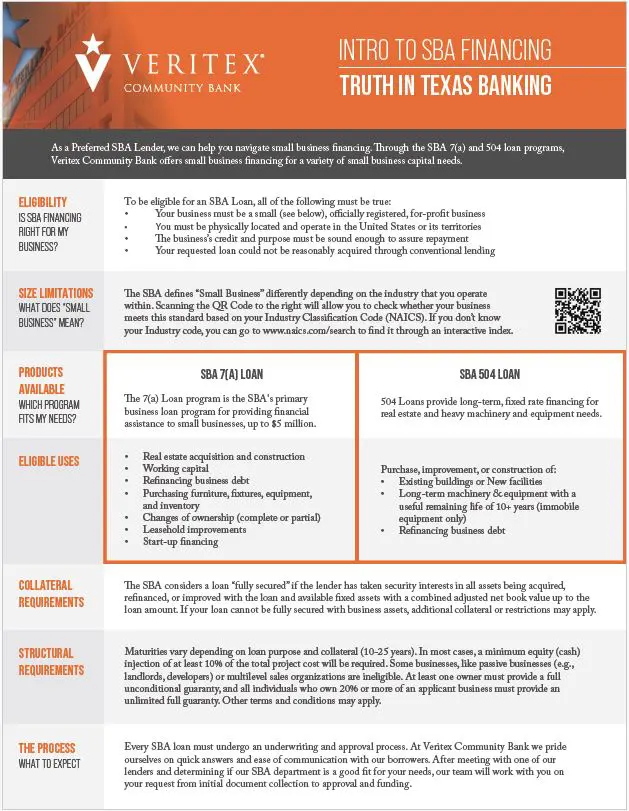

SBA 7(A) loans can be used for most business financing related goals with terms up to 25 years.

Here are a commonly used business needs business owners use with 7(A) funding:

- real estate acquisition

- renovating or constructing a building

- leasehold improvements

- equipment

- inventory

- furniture and fixtures

- business acquisitions

- working capital

Which SBA loan is right for you? Speak with a Veritex Banker to determine which option works for your business. In the meantime, consider these terms:

SBA 7(A) Loans

- Loan Amounts: From $100,000 to $5,000,000

- Loan Terms: Up to 25 years for buying or refinancing real estate; up to 10 years for equipment and working capital

- Ideal For: Expanding your business or purchasing new commercial real estate, equipment, and working capital.

SBA 504 loans can be used for financing major fixed assets, promoting business growth and job creation.

Here are a commonly used business needs business owners use with 504 funding:

- real estate acquisition

- renovating or constructing a building

- purchasing equipment

- refinancing debt

- fixed assets

Which SBA loan is right for you? Speak with a Veritex Banker to determine which option works for your business. In the meantime, consider these terms:

SBA 504 Loans

- Loan Amounts: From $250,000 to $10,000,000

- Loan Terms: Up to 25 years for buying or refinancing real estate

- Ideal For: Purchasing owner-occupied commercial property

For more details, please contact one of our SBA Directors listed below.

USDA Loans Loans specifically designed for rural businesses, visit our partner, North Avenue Capital.

For more details, please contact one of our SBA Directors listed below.

For more information on any of our SBA services, please contact:

Kirk Beason

EVP, SBA Managing Director

Government Guaranteed Lending

(713) 275-8203

Heidi Whitesell

SVP, National Sales Director

Government Guaranteed Lending

(972) 587-6697

Who is eligible?

SBA loans are available to businesses that meet the following criteria, among others:

- A for-profit business officially registered and legally operated within an eligible industry (excludes lending, gambling, and religious activity)

- Physically located and currently (or planning to be) operating in the United States

- Owner must have equity in the business

- Has a need for funds and has tried to secure alternative financing before turning to the SBA

- Must be a “small business” as defined by the SBA (details at sba.gov/size-standards)

How does the SBA and Veritex work together?

SBA loans are offered and guaranteed by the Small Business Administration, but facilitiated through banks like Veritex Community Bank. As your small business lending partner, Veritex will act as your advocate throughout the application and funding process.

Why Veritex Community Bank?

At Veritex Bank, our guiding tenet is Truth in Texas Banking. It’s a principle that comes from our name itself. Veritex comes from Veritas, which means truth, and of course, Texas. This promise rests on the back of our character. Here, we believe that character is everything. Our small business lending experts are familiar with the unique needs of small enterprise, and act as true partners in the funding process.